Revisions are often precursors to earnings surprises. Revisions to earnings estimates lead to price adjustments similar to earnings surprises.

AERCAP SHARE PRICE HISTORY FREE

Sign Up to Receive a Free Special Report Showing How A+ Grades Can Help You Make Smarter Investment Decisions You can view 30-, 60- AND 90-day quarterly consensus estimates as well as fiscal data for AerCap Holdings N.V. Out of the 8 analysts who made earnings estimates, 2 analysts downgraded their estimate and 2 analysts upgraded their forecast over the last month. Perhaps the economic outlook is better than previously expected, or maybe a new product is selling better than anticipated.įor the next quarter, the consensus estimate for AerCap Holdings N.V.’s stock is based on 8 analysts. Revisions in earnings estimates reflect changes in expectations of future performance on the part of analysts. The current consensus earnings estimate for the next quarter for AerCap Holdings N.V.

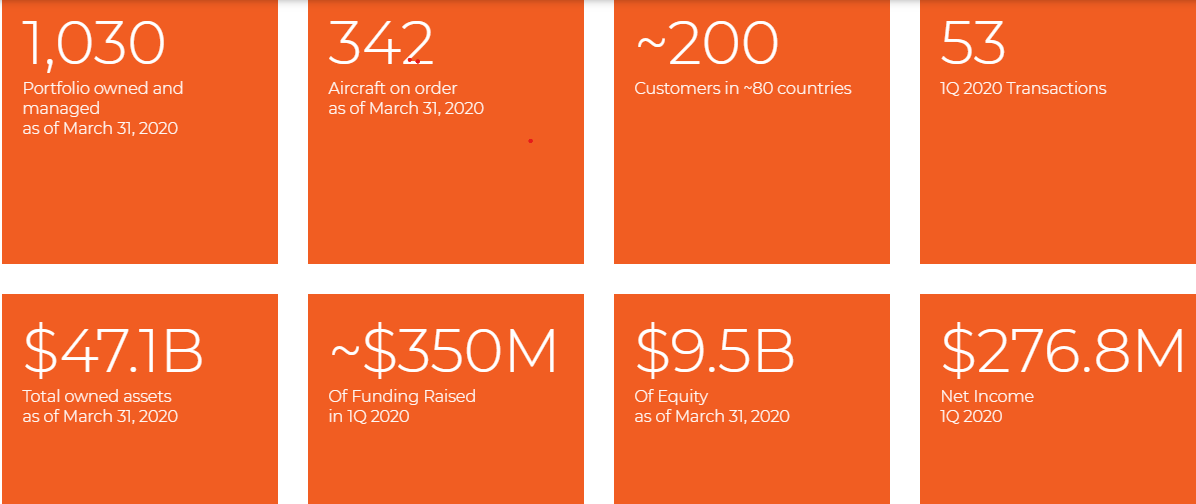

This consensus estimate was based on several factors. This quarter, AerCap Holdings N.V.’s stock beat analyst predictions for earnings per share during the Q2. The number of estimates provides a feel for the depth of coverage for a company. The number of analysts tracking a company depends on its size -large-cap stocks often have more coverage than small caps and mid-caps. Stocks with earnings estimates may have anywhere from one to 30 or more analysts tracking and analyzing them. The consensus earnings estimate is calculated by a small number of companies, such as I/B/E/S, who are given the data by the participating brokerage firms. The consensus earnings estimate is the average of all published forecasts for a specific company or index. Earnings estimates are the profit forecasts made by brokerage firm analysts. If you follow quarterly earnings reports and news coverage, you may hear that a specific company has “missed” or “beaten” its estimates. Consensus Estimates for AerCap Holdings N.V. Report Dateįor more information about AerCap Holdings N.V.’s earnings and consensus data, click the button below to subscribe to A+ Investor or log into your existing account. You can see the analyst consensus, rating, recommendations, history and industry rank by becoming an A+ Investor subscriber. The table below gives a quick snapshot of key earnings data for AerCap Holdings N.V.’s stock. This represents year-over-year growth of 7.5%. Revenue: $1,759 million, versus $1,636 million in the same period one year ago. Earnings: $2.56 per share, versus the consensus estimate of $2.06 per share, according to AAII’s Stock Investor Pro, Refinitiv and I/B/E/S. Let’s take a look at how AerCap Holdings N.V.’s stock performed this quarter. Earnings are one of the most important metrics that investors assess in a company’s financial statements before deciding whether to invest or not. ( AER)Įarnings represent a company’s after-tax net income, which is its bottom line. Now, let’s delve into the nitty gritty of AerCap Holdings N.V.’s Q2 earnings report.

reported quarterly earnings of $2.56 per share. Key Takeaways From AerCap Holdings N.V.’s Q2 Reported Earnings:

AERCAP SHARE PRICE HISTORY HOW TO

Understanding how to interpret a company’s earnings report can give you an advantage as an individual investor and will help you to determine if AerCap Holdings N.V.’s ( AER) stock is worth adding to your portfolio or not. Note however, that many companies announce their quarterly and annual results well before their filing deadlines. Large companies must file their annual results 60 days after completing their fiscal year-end. Securities and Exchange Commission (SEC) every quarter, 40 days after the completion of their fiscal quarter. They represent the bottom-line amount of money that a company creates from its sales or revenue.Ĭompanies of domestic, publicly traded U.S.-listed stocks are required to officially report their earnings to the U.S. Lower multiples reflect lower perceived prospects as well as greater risk and uncertainty of achieving results.Įarnings are a company’s net profit, measured either on a quarterly or annual basis. Stocks with high price-earnings ratios not only have high expectations, but they also possess a higher anticipated certainty of realizing their growth. A slight change in projections can have a major impact on stock prices, especially if the multiple, or price-earnings (P/E) ratio, that investors are willing to pay for a given level of earnings also expands or contracts. Stock prices are established through investor’s expectations and adjusted as those expectations change or are proven wrong.

0 kommentar(er)

0 kommentar(er)